PRGX WORKING CAPITAL ACCELERATION

Unlock Millions in Working Capital. Fast.

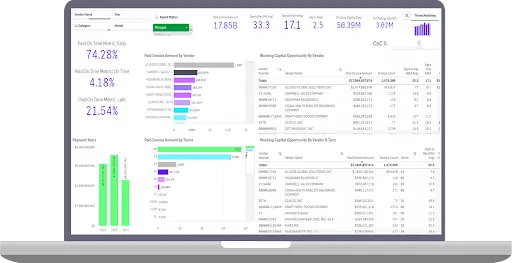

PRGX combines audit precision, consultative insights, and payment data dashboards to share customized playbooks that deliver measurable cash flow improvements—without disrupting operations.

What You Need

A targeted working capital acceleration program that identifies and captures cash trapped in your source-to-pay cycle.

What You Get

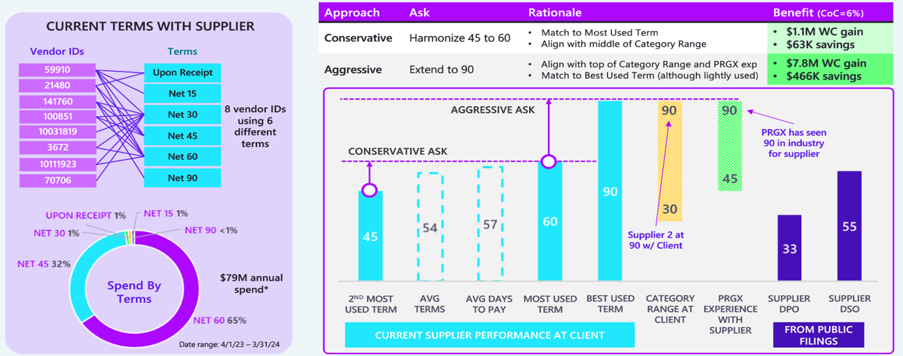

- Quantify working capital improvement opportunities using your actual transaction-level payment data

- Model new payment terms across vendors and categories to unlock cash

- Assess and improve cash discount utilization

- Benchmark supplier terms and harmonize for maximum value

- Custom playbooks with fact-based negotiation guidance

Why Our Process Works

Even high-performing finance teams leave money on the table. Our combination of industry-leading expertise and PRGX Spend & Payment Insight software uncovers and unlocks the most value.

Let’s unlock your working capital

Ask us how we can deliver results in 30 days.PRGX Working Capital Acceleration

How does PRGX identify working capital opportunities we’re missing?

We analyze payment behaviors from your data—across vendors, categories, and systems. By examining how and when payments are made, we uncover early payments, missed discounts, and term misalignments that trap cash unnecessarily.

What makes PRGX’s insights different from what our team already sees?

Our Spend & Payment Insight software delivers a unified view across fragmented systems, layered with supplier benchmarking and root-cause analysis to surface actionable gaps and savings.

Can PRGX help us negotiate better terms with suppliers?

We don’t negotiate on your behalf—but we equip your team with custom playbooks built from your actual payment data, supplier benchmarks, and industry insights. These playbooks provide fact-based recommendations that empower your team to negotiate smarter and unlock working capital.

How quickly can we see results?

We deliver actionable insights within the first 30 days—based on your actual payment behavior and transaction-level data. While negotiation and implementation take time, some clients have unlocked millions in working capital starting from a single vendor analysis.

Will this disrupt our operations or vendor relationships?

Not at all. We provide your team with the facts, benchmarks, and playbooks needed to enact change—without requiring direct supplier engagement from us or disrupting your existing relationships.